Data-driven anti-money laundering

- Department Statistical modelling and machine learning

Money laundering is an enormous global issue, allowing criminals to profit from illegal activities. Effective anti-money laundering (AML) initiatives rely on strong collaboration between stakeholders. At NR, we develop data-driven methods to detect suspicious financial activity and strengthen efforts to combat money laundering.

Illustration: Fredrik Johannessen.

Detecting and reporting money laundering

Under the Anti-Money Laundering Act, banks are required to report suspicious financial activity to the National Authority for Investigation and Prosecution of Economic and Environmental Crime (Økokrim), which investigates cases and takes legal action against involved parties. This places banks at the forefront of anti-money laundering efforts, making it critical that they are equipped with efficient and precise tools to detect suspicious financial behaviour.

Historically, money laundering detection systems have relied on manual rule-based approaches, but in recent years data-driven solutions have become increasingly important in preventing financial crime.

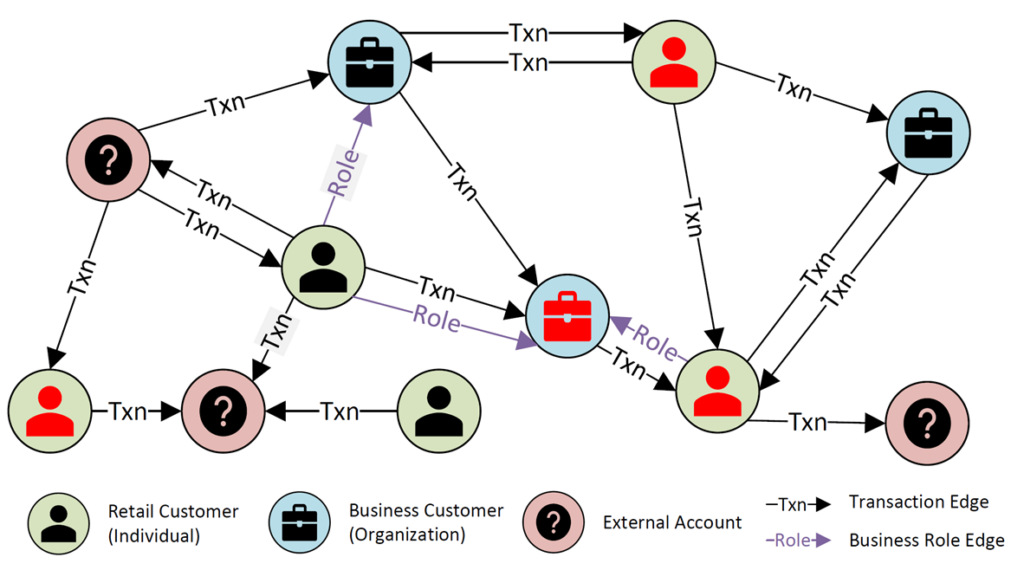

Network-based risk models and suspicious transaction patterns

Through our role in the BigInsight research centre, NR har led the development of transaction-based machine learning methods for anti-money laundering. This work, carried out in close collaboration with DNB over several years, includes models based on individual customer data, transaction histories, network-based risk models, and the detection of suspicious transactional patterns.

Strengthening AML collaboration in the financial sector

Effective anti-money laundering efforts rely on strong collaboration between key stakeholders. With this in mind, we hosted the seminar “Machine learning and anti-money laundering collaboration in the financial sector,” in June 2024.

Funded by the Finance Market Fund, the seminar was designed for professionals working with anti-money laundering in the banking sector. It brought together more than sixty participants from over ten banks, featuring presentations from Økokrim, the Police IT Unit, the Danish Financial Supervisory Authority and representatives from the the financial sector.

Advancing education in AML research

Senior Researcher Martin Jullum has played an active role in educating future experts in data-driven anti-money laundering. He supervised Fredrik Johannessen’s master’s thesis in Data Science at the Department of Mathematics at the University of Norway, and co-supervised Osama Abidi’s thesis in Industrial Economics at the Norwegian University of Life Sciences (NMBU). Both students used transactional data from DNB in their research.

Additionally, Jullum served as first opponent for the doctoral thesis, On the Applications of Machine Learning for Alleviating Challenges in the Financial Crime Domain by Abdallah Alshantti at the Department of Engineering Cybernetics at the Norwegian University of Science and Technology (NTNU).

To learn more about our work in anti-money laundering, get in touch.

Publications